If you are a young millennial working your first post-college job, saving for your future is the last thing on your mind. You’ve got other concerns – like paying your bills.

We get that. Money is tight. While the numbers on your paycheck may have initially bedazzled your eyes, reality has sunk in with a big thud. Living on your own, paying your own way is more expensive than you thought – way more. Your paycheck has a multitude of claims demanding a piece of it. There’s food, rent, utilities, student loans, a car payment, gas, insurance, phone … blah, blah, blah. The depressing list goes on, right? How are you ever going to save money?

Believe it or not, you can, and it starts with asking yourself a very simple, albeit painful question.

Do I need this?

Yup. The old “want versus need” issue.

You may have a paycheck bigger than you’ve ever seen, but you still don’t have carte blanche to go buy everything your heart desires. (A sad, cold truth.) Most likely, your heart desires a lot. Like your daily Starbucks fix, for instance. Sure it tastes good (and powers you through the day!). But, is it possible to cut back to one caramel macchiato a week? Maybe plug in the old coffee maker at home the rest of the time? How about lunches? Could you pack a sandwich or yogurt instead of hiking to Sushi Land or Chipotle? And do you really need a subscription to both Netflix and Hulu? Or a phone upgrade this year?

You get the drift. There are many ways to trim little things from our lives — ways that are fairly painless but that add up over time to make a big financial impact.

Saving up a million bucks

Dream a little here. What would it take for you to have a million bucks saved by the time you’re 65? Is that even possible?

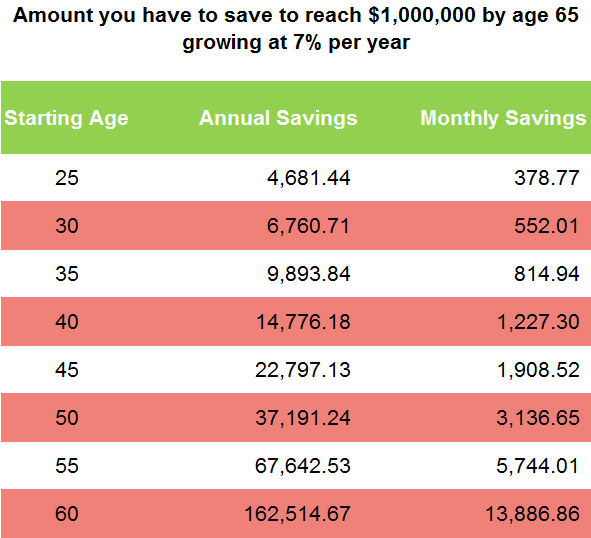

If, at 25, you saved $378.77 from your paycheck each month, and that money grows at 7% each year, you’d have a million dollars saved by the time you reached 65.

Whoa, whoa, whoa. Save $378.77 each month? At 25? No way, you say!

Maybe there is a way.

Painless ways to save

Save the raise

Let’s say you’re 25, your boss just gave you a raise, and now you’re thinking, new car. The monthly payment is going to be $400. That’s a lot, but you could swing it. Or, you could hold off buying that new car and put the money into a retirement account.

Cut extra expenses

Maybe you’re not getting a raise or a new car, but making it your mindset to eliminate or defer extraneous large and small expenses and then socking the savings into a retirement account can make what seemed impossible, possible. It’s a game changer.

Contribute to your 401(k)

Another fairly simple way to beef up your savings is to take advantage of your company’s 401(k) plan, if they offer one. If you make contributions each pay period and your employer offers a match, that’s free money! You can also save by putting a large share (like half, if you dare) of any raises you receive into your 401(k) or other savings.

The plain truth is this. When it comes to saving for retirement, earlier is better.

If you wait to start saving until you’re 30 (check out the chart), you’d need to salt away $552.01 each month to reach a million by age 65. At 40, it jumps to $1,227.30 each month. At 50, $3,136.65 each month and at 60, a whopping $13,886.86 each month. And, we hate to say it, but saving money will not get any easier as the years pass. Financial responsibilities usually increase as you age. Your future self will probably have a mortgage, kids, college costs, aging parents, and so on.

Here’s the good news. Most likely, if you start early, you will not miss the money you are putting away. And if you keep it up, with the power of compounding, you will have a sweet surprise waiting for you when you retire.

Don’t wait. Start saving today.

Advisory services are offered by Joslin Capital Advisors, LLC, an SEC Registered Investment Advisor.