by Mike Joslin

My mom’s older sister passed away, alone, in Colorado in April. She had just turned 97. She did not die of Covid, but the virus still left its mark. No one from the family was allowed to be with her during her final days. It was a sad time for us.

A little bit about my aunt

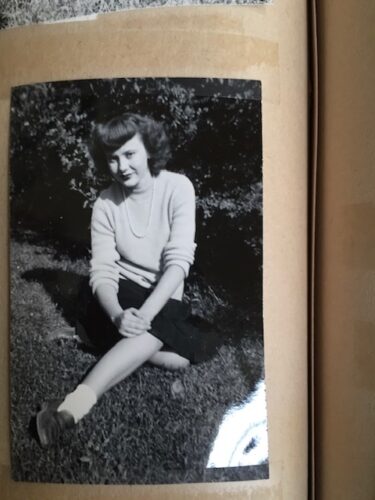

My aunt in pearls and bobby socks.

My aunt was married to her sweet husband, a WWII vet, for almost 60 years. He died a little over 10 years ago. They never had any children of their own. Maybe that’s why they made it a point to always be there for my sisters and me. Not a birthday or holiday passed that we didn’t hear from my aunt and uncle.

Though my aunt didn’t have children, she kept herself plenty busy. Throughout her life, she delved into genealogy and scrapbooking, and collected paper dolls, silver spoons and various coin sets. (Oh the treasures (?) we found tucked away in her home!)

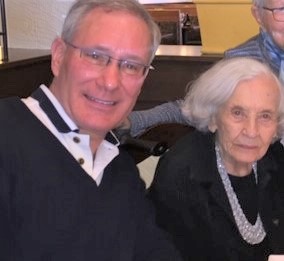

My aunt on the left and mother on the right.

I think every birthday growing up, I would get a small package in the mail from the Denver Mint. Carefully opening each box, I would look in wonder at the shiny, new coins that represented the mint’s issue for that particular year. (I now have a safe deposit box full of these sets, and look forward to passing them on to my sons someday. Or maybe grandkids, when and if they might ever arrive!)

Will you be my executor?

Being in the wealth management business, helping people get extra-organized as they prepare for their inevitable demise comes as second nature to me. So, with no kids of their own, my aunt and uncle long ago asked me to be their executor. I was honored by their trust and accepted this duty without a second thought.

Now as executor, I honestly felt I had done a good job organizing my aunt’s affairs. I made lists, tracked her various bank accounts and assets, and paid her bills in the last four to five months of her life, when she just stopped paying attention to her finances (so unlike her!).

Unexpected problems

But after her death, I encountered some big hurdles that I wasn’t expecting. Things I wish I could have avoided.

Me on the left, my aunt on the right

While my aunt displayed her tender side through her thoughtful cards, letters and gifts, she was not inclined to open up about her financial affairs – even to me as her executor. The older she got, the more unwilling she became to share anything. The result was that I was left with a big mess to sort through (which I’m still working on!).

In the aftermath of my aunt’s passing, while I work on finalizing her estate, I’d like to share a handful of tips that I wish someone had shared with me.

6 lessons in estate planning

1. If executor, get full and immediate access to all financial information

No question about it. I would insist that I be given full and immediate access to information about, and sufficient time to discuss and document, all financial affairs. This includes wills, trust documents, a detailed listing of holdings and key contacts, and an understanding of post-mortem planning goals.

Furthermore, start gathering all this information immediately after you assume this role. Even if things change over the years, it’s better to start early and have some history on the individual’s situation. Don’t wait until they are ill or become forgetful, or worse.

In my aunt’s case, when I saw her in February this year, I asked her a question about a particular bank account and she threw up her hands, exclaiming, “I don’t know and I don’t care anymore. You’ll just have to deal with this after I’m gone.” Huh? This was not the aunt I knew even a year prior. I learned this sort of mental degradation frequently happens. So get things lined up sooner than later.

2. Create an organizational spreadsheet

As a former CPA, simple spreadsheets come easily to me. When my uncle died in 2008, I created a spreadsheet with multiple tabs to lay out all his and my aunt’s assets, income sources (Social Security, pensions, etc.) and contact information (funeral home, CPA, attorney, etc.). This was a godsend to have when my aunt passed away.

It’s not fancy, but if you’d like a copy of the template I developed while working on my aunt and uncle’s estate, call us at our office and we’ll send it to you, gratis.

3. Take pictures of all valuables – ASAP!

My aunt moved from her townhome to an independent care facility three years ago. Given the timing, neither I nor my two sisters could fly in to help with the move. My aunt was advised to hire an “estate liquidation consultant,” who, in short, charged her a fortune for moving what little she kept, and pocketed much of the rest of her goods. I assume he sold much of her furniture and many of her collections at a substantial profit, over and above his moving and liquidation charges.

When she passed away, her wedding ring and two other rings she always wore simply disappeared. No one claimed to have seen them – ever. Without a picture of what was lost, and because she did not have her rings insured, we could not file an insurance claim.

4. Do a lifeboat drill with professionals before your loved one passes

On the day my aunt died, I called her estate planning attorney and CPA in Colorado Springs to notify them of her passing. The CPA was fairly straightforward about what he would need to complete her “short-form” 2020 tax returns (federal and state), as well as additional information necessary to file her 2019 return, which was put on extension. So, the CPA was pretty organized.

In contrast – and not to disparage any of my attorney friends – it was hard to get any direction or clear answers from the estate planning attorney.

My aunt had told me that she had paid an annual fee to the attorney, which I assumed covered the immediate post-mortem filings, like getting a tax ID number for her trust, and a letter declaring me to be her personal representative.

Nope.

Essentially, this information was held for ransom until I paid a sizable additional fee. After receiving the document with the coveted information, I laughed. It was so simple I could have created it myself! The attorney implied that this was something he needed to create and file with “the court.” This is just not true.

So the lesson here is that I should have insisted on visiting the attorney’s office on a previous trip and done a “dry run” to determine what needed to occur upon my aunt’s passing. That way I would have in writing what the attorney would (or would not!) provide, and at least an estimate of any charges.

As an aside, for some reason (that neither I nor the insurance agent who sold the policy can figure out), the attorney changed the ownership of a single-premium tax-deferred annuity to my aunt’s trust.

This is typically not advisable, since like IRA and other retirement accounts, annuities have designated beneficiaries who would receive their share of the policy value upon my aunt’s passing. My aunt never shared the details of this policy with me, nor did the attorney ever keep me in the loop as to the change in ownership or underlying rationale.

We’re now working to fix this situation, which will take a fair amount of time and money to do. It’s a headache that could have been completely avoided with communication with my aunt and the attorney.

5. Get your timing down with the banks

Make sure that all paperwork designating you as personal representative with any banks is completed as soon as possible. After my aunt died, I wrote checks on two of her bank accounts, first getting the okay from the banks. In both cases, the checks bounced. The banks’ own systems had a lag between when my aunt passed and when the paperwork acknowledging me as her personal representative and trustee of her trust were processed. In short, I was too efficient!

So, ask the banks two questions: “First, how long will it take them to process their paperwork to convert accounts held in an individual name to that of an estate or trust?” and second, “How much time should you allow for their internal protocols to be completed (for you to write, and for them to clear checks)?”

6. Confirm terms of service with care facilities

Passing away during Covid, my aunt’s independent care facility gave us a fair amount of slack about how long we had to remove her belongings – especially since we were in another state. However, once they opened up to allow outsiders in (a month after her death, so in mid-May), we were given one week to clear out her apartment. (We could have used two.) After the one week, we would have faced hefty extended occupancy fines.

My wife and I then cleared our calendars, flew to Colorado and spent six exhausting days and nights ( about 14-16 hour days) going through my aunt’s personal stuff, collections, etc., making tons of trips to thrift stores to give away clothes and furniture. Then there were the trips to Office Depot, to shred unnecessary, sensitive documents.

It was a harrowing week.

By mid-week, we felt there was no way we would be able to completely clear out all of my aunt’s stuff by the time we were scheduled to fly back to Seattle. We ended up shipping 13 large boxes of her belongings back to our home (not cheap!), which gave us the breathing room we needed to continue sorting through and cataloguing her belongings, as we prepare to distribute them to my two sisters and me.

~

We’re still working through my aunt’s affairs. With both a new estate planning attorney and CPA on board, we’re aiming to settle most everything by early January, before the associated tax filings are required. It has been a whirlwind, for sure!

I would feel better knowing that others could avoid some of the pitfalls I encountered by following these estate planning tips. After all, part of the value of any painful lesson, is passing it on to help others.

Advisory services are offered by Joslin Capital Advisors, LLC, an SEC Registered Investment Advisor.