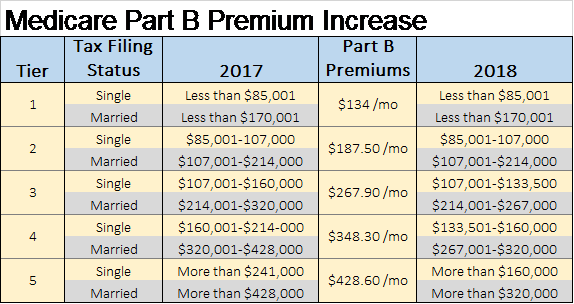

Expect to see your Medicare premiums jump in 2018 if your income exceeds $133,500 a year (single) or $267,000 (married). In fact, if you do have income at this level or higher this year, you’ve probably already noticed a jump.

Why the jump

Back in 2015 Congress passed a law that would allow increased reimbursements to physicians. While this was great news for doctors, who potentially faced big cuts in pay, the impact on wealthy Americans enrolled in Part B of Medicare wasn’t nearly as pleasant. To fund these reimbursements, Medicare reduced the threshold to some of the income brackets (or tiers) that trigger Part B surcharges, starting in 2018. Basically, this means more people will pay higher premiums.

Well, 2018 is here and it’s time to pay the piper.

Make more pay more

Under Medicare Part B (which covers doctors’ fees and outpatient services), enrollees deemed to have a “higher income” have a surcharge tacked onto their premium. This surcharge is called the “income-related monthly adjustment amount” — better known as IRMAA (hurricane IRMAA to some).

It’s a familiar rule of thumb — make more, pay more.

Now, most Americans won’t have to worry about higher premiums because they don’t fall into the higher-income camp that prompts these surcharges. Their premiums should hold steady at 25 % of Part B costs, with the government picking up the remaining 75%. That translates to a per-person premium payment of $134 a month (and maybe even less in some cases).

But higher earners whose modified adjusted gross income (MAGI) exceeds $133,500 will have to cough up more this year. (Note: the MAGI includes tax-exempt interest. Also note that your MAGI is based on the tax return you filed two years ago.)

Here come more details in dollars and cents, so buckle up.

What’s your income bracket?

There are five income brackets in Medicare. The first bracket is not considered higher income. (No surcharge!) The next four are.

Income Bracket # 1 — $85,000 or less

If your modified adjusted gross income (MAGI) is $85,000 (single) or less, your premium remains at the $134 level or less and is free from any higher-income surcharge.

Income Bracket # 2 — $85,001 — $107,000

This next bracket — the first of the higher income tiers — is for individuals making $85,001 — $107,000. Folks falling into this bracket can breathe easy. It remains unchanged, with no increased surcharge from last year. Still $187.50 a month.

However, the next three income brackets all have lowered thresholds this year, pushing more people into higher tiers with higher premiums.

Income Bracket # 3 — $107,001 — $133,500

Bracket # 3 (with a monthly payment of $267.90) previously included individuals making anywhere from $107,001 to $160,000. That $160,000 cap has now dropped to $133,500.

Income Bracket # 4 — $133,501 — $160,000

In bracket # 4, threshold amounts have shrunk even more. The old threshold ranged from $160,001 to $214,000. Today’s threshold extends from $133,501 to $160,000, with a premium of $348.30.

Income Bracket # 5 — $160,001 +

The fifth (and highest) bracket was previously reserved for individuals earning more than $241,000. Now that bracket has extended its reach to include anyone making more than $160,000, triggering the highest monthly premium of all — $428.60 per person. That means a married couple in this income tier will pay Medicare Part B premiums exceeding $10,000 this year!

Check out the premium changes from 2017 to 2018.

Bottom line? Depending on the modified adjusted gross income you reported to the IRS two years ago, you could be paying a whole lot more in Medicare premiums this year.

And we haven’t even talked about Part D — that’s a blog for another day.

(Data from Medicare.gov.)

Advisory services are offered by Joslin Capital Advisors, LLC, an SEC Registered Investment Advisor.