It’s February, and while some of you have love on the brain, we financial professionals have taxes on the brain.

Most likely this year you’ll complete your tax return just as you have in years past. But with the Tax Cuts and Jobs Act bill passing Congress in December 2017, the 2018 tax year promises change.

Differences in income tax brackets, deductions and tax credits are some of the biggest game-changers headed your way. For most of you, these changes will mean more money in your pocket and less in Uncle Sam’s.

7 key changes

1. Most marginal brackets will be lower

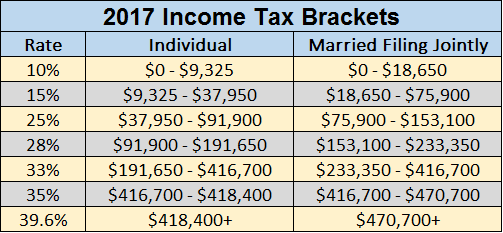

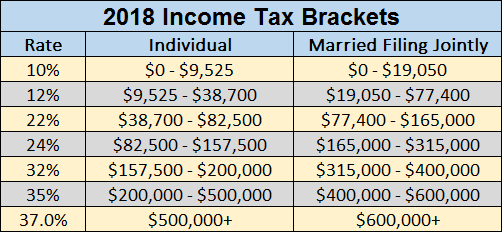

Because our tax code is progressive, your tax rate rises with your income. A marginal tax rate is what is taxed on the “margins” or ends of your income, rather than the total income. In other words, your income is divided into sections of amounts and each section has a different marginal tax rate. As your income moves beyond a certain section your marginal tax rate will increase.

As you can see in the charts, the seven marginal tax brackets remain and most will be lower in 2018.

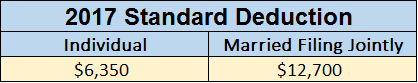

2. The standard deduction will almost double

With a nearly doubled standard deduction and no clear advantage to itemizing, most people will opt for a simplified return over an itemized one.

3. Personal exemptions will disappear

Before the new tax reform law, you could claim a personal exemption of $4,050 (2017) for each taxpayer and each dependent. This will disappear in 2018. However, the child tax credit will be increased and the phase-out limit significantly increased as well.

4. State, local, and property tax deductions will be capped

The deduction for state, local and property taxes will be limited to $10,000 (married filing jointly). If you live in a high-tax state, this new limit will hurt you the most.

5. Mortgage interest deduction will be capped

For mortgages taken after December 15, 2017, the maximum amount from which you can deduct interest will be $750,000 — down from $1 million currently. However, the good news is, if you have a pre-existing mortgage, you can still deduct interest from a debt of up to $1 million.

6. Estate tax lifetime exemption will double

Going forward in 2018, the estate tax exemption will be $11.2 million per person. For 2017, the exemption was $5.49 million per person. (Note: the annual gift exclusion will increase from $14,000 per person per year, to $15,000.)

7. Capital gains tax rates remain pretty much the same

There are still three tiers to the long-term capital gains tax rate — 0%, 15%, and 20%, with 15% being the most common rate. Lower income-earners (those in the 10% and 15% income tax brackets) will pay no capital gains tax. However, high-income earners will still pay a 3.8% net investment income tax surcharge for capital gains.

Most people would agree that the new tax reform law is not without its flaws. But most would also agree that reform is needed.

This is a start.

*For information on how the tax changes will specifically affect your taxes, please consult a professional tax advisor.

*Data gathered from MoneyGuidePro and ThinkAdvisor.com.

Advisory services are offered by Joslin Capital Advisors, LLC, an SEC Registered Investment Advisor.